Credit Basics

Here we breakdown the basics on credit.

Dealership Experience

A retail installment sale is a transaction between you and a dealer to purchase a vehicle where, you agree to pay the dealer over time, paying both the value of the vehicle plus interest. A dealer can sell the retail installment contract to a lender or other party. The retail installment contract is arguably the most important document you will sign when financing a car.

The intent of this article is to provide a review of key elements. However, be sure to read the entire contract, ask questions, and understand your obligation before driving off the dealer lot.

Note: your retail installment contract may look different depending on the lender and state. All unused lines on the contract should be filled in with “NA” or “0.”

1. Tops of contracts typically have an area for your name, full address, and that of the seller (the dealer). This information repeats on other documentation and is used by lenders to among other things send billing statements and communications. Verifying the information is a simple, important task.

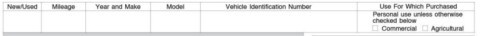

2. Likewise, you want to make sure all of the information in the vehicle section is correct. The vehicle identification number (“VIN”) is found in several locations, including the driver’s side dashboard nearest the windshield. In general, the commercial or agricultural box will be checked only when the primary use is for conducting business.

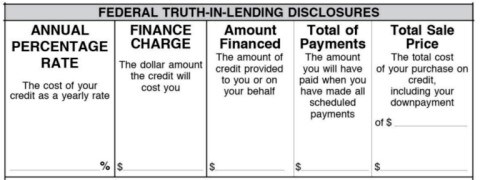

3. The Truth-In-Lending disclosure area includes five boxes that summarize the details of your purchase.

Box 1, The Annual Percentage Rate or APR is what you are charged each year to finance the purchase.

Box 2, Finance Charge uses the APR to calculate the dollar amount to finance your purchase over the life of the contract. Learn more about finance charges here.

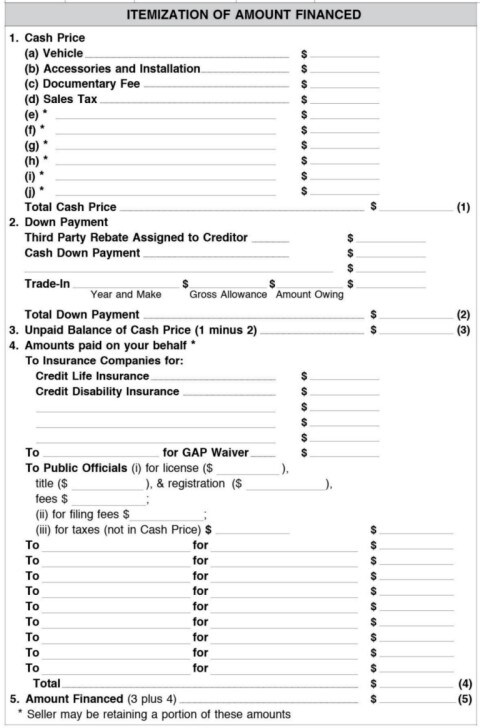

Box 3, Amount Financed, comes directly from the last line of the itemization section, shown below. This figure is the price of the vehicle, plus taxes, fees, and optional add-ons like an extended service plan, minus any down payment (cash, trade, and rebate).

Take your time reviewing the itemization table and if unsure of any amount, ask the dealer for clarification.

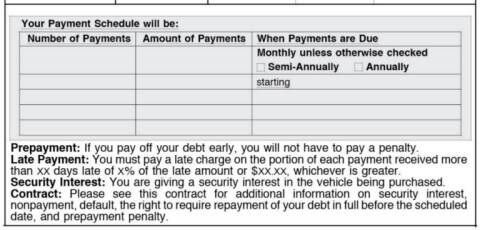

Box 4, Total of Payments, is equal to the number of scheduled payments times the payment amount. The dollar amount(s), number of payments, and due date(s) comes from the payment schedule section of a contract, shown here.

The payment schedule section also provides information on paying the contract off early, consequences of making a late payment (can vary by state), and a security interest (title/lien). In general, the first payment is due 30 – 45 days following the date of the contract.

Box 5, Total Sale Price can be viewed as the “all-in” number meaning, that amount is really what the vehicle will cost after all payments are made. Calculate the Total Sale Price by adding up the cash price of the vehicle, optional add-on products, taxes and or fees, and finance charges. Each of these amounts is in the itemization section.

When it comes to financing, a lower APR means lower total finance charges, lower payments, and a lower total sale price.

Here we breakdown the basics on credit.

The ins and outs of financing a car.

Tips for managing your account and lease end.