Credit Basics

Here we breakdown the basics on credit.

Dealership Experience

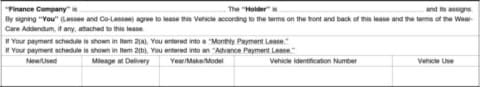

Leasing has a vocabulary all its own. For starters, rather than a buyer you are the “lessee,” and the company (FMCC) you lease from is the “lessor.” A dealer can assign the lease agreement to a lender or other party.

A lease is an agreement to use a vehicle for an agreed number of months. You do not own a leased vehicle and are required to return the vehicle when the lease ends unless you exercise a purchase option, if applicable.

The intent of this article is to provide a review of key elements. However, be sure to read the entire agreement, ask questions, and understand your obligation before driving off the dealer lot.

Note: your lease agreement may look different depending on the lessor and state. Unused lines should be filled in with “NA” or “0.”

OK, let’s have a look around a typical lease agreement.

1. The top of the agreement has an area for your (lessee) name, full address, and that of the dealer (lessor). This information repeats on other documentation and is used by lessor to among other things send billing statements and communications. Verifying the information is a simple, important task.

2. Likewise, you want to make sure the vehicle information is correct. The vehicle identification number (“VIN”) is found in several locations, including the driver’s side dashboard nearest the windshield. In general, the vehicle use field will indicate ‘personal’ unless the primary use is for conducting business.

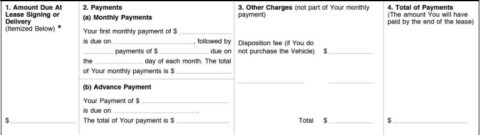

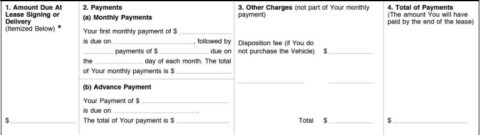

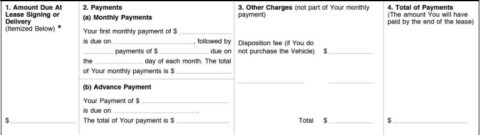

3. These next four boxes are a summary of how much is due upfront, the amount due each month, other charges, and the total obligation.

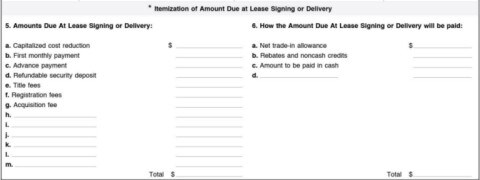

Box 1, the amount due at lease signing, comes directly from the itemization section, shown below. Lines 5a – 5m show the type(s) and amount due; whereas lines 6a – 6d show the source(s) of the amount due. The totals shown in columns 5 and 6 will match.

Box 2 shows the first payment amount and remaining payments schedule. Your first lease payment is due and collected at delivery. An advance payment is shown only if the lessee intends to make all payments upfront.

Box 3 indicates other charges and fees you may owe at lease-end.

Box 4, is the sum of the amount collected at lease signing (box 1), remaining lease payments (box 2), and other charges (box 3), if applicable.

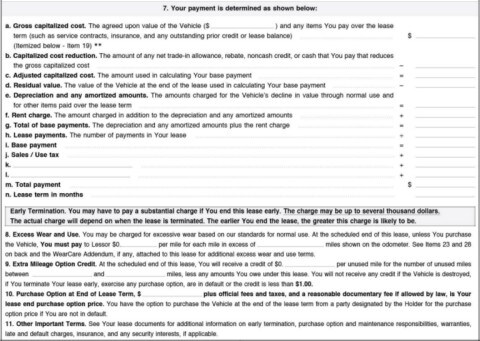

4. This next section shows how your payment is calculated. For many people, leasing is a convenient and affordable way to get into a new car more frequently, but the terms and fees differ quite a bit from a conventional purchase. Many of those terms are defined here.

Here we breakdown the basics on credit.

The ins and outs of financing a car.

Tips for managing your account and lease end.